Lipan, Texas

We purchased a performing loan on a 100+ acre horse ranch, including a home, arena, barns, etc. The note was purchased at a discount to yield 10.9% with a 62% ITV.

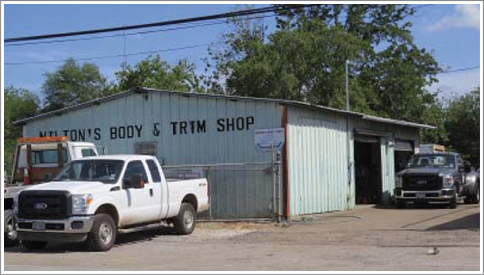

Refugio, Texas

We purchased this note at a substantial discount. When the original payor stopped making payments, we foreclosed and immediately resold the property with seller-financing for 3x our original investment.

Port Huron, Michigan

We purchased this bank-owned home sight-unseen for $4,600 in a bulk package of distressed properties. The interior of the house was in poor condition. We sold it “as-is” with seller financing for $33,500. The buyer completed repairs and has been making payments for years.

Grand Rapids, Michigan

We purchased this bank-owned property that needed plumbing repairs, paint, carpet, etc. We paid $7,000 and then sold the property in less than a week “as-is” with seller-financing for $29,500, and got $7,000 down!

Birmingham, Alabama

We purchased this bank-owned property for $3,500 in a bulk package of distressed homes. The house needed paint, plumbing repairs, bathroom fixtures, and kitchen cabinets. We sold it with seller financing and had all our money back the first year. The buyer stopped paying and we got it back after a couple of years, then we rented it for a few years after that, then sold it again for cash to an investor. A little bit of hassle, but extremely profitable.

Multiple States

We purchased several packages of REO properties from national and regional banks for 1.1MM. Most of the properties were marketed with seller-financing and some were sold for cash to local investors. Our primary objective with this package was to create long-term cash flow secured by real estate. This package generated 500k in cash and over 3MM in notes paying 30k+ per month.